An Analysis of Starbucks Finances Amidst Pay Disputes

Starbucks' Finances: Triumphs, Challenges, and the Brew of Corporate Responsibility

In the world of coffee commerce, few names resonate as strongly as Starbucks. As we delve into the financial underpinnings of this global coffee giant, the atmosphere is charged with more than the scent of freshly brewed employee unrest. Recent headlines report the discord between Starbucks and its employees, escalating into a planned walkout over ongoing pay disputes.

In this blog, we embark on a comprehensive financial review of Starbucks, a company whose success has become synonymous with premium coffee experiences. Yet, as the aroma of espresso fills the air, so too does the tension of a labour disagreement that has garnered attention far beyond the coffeehouse walls.

Join us as we navigate through the fiscal landscape of Starbucks, exploring the numbers that underpin its global empire and examining how recent labor disputes might reverberate through its financial statements. From revenue streams to operational challenges, we'll unravel the complexities brewing within the financial narrative of Starbucks. The journey promises insights into not only the company's fiscal health but also the intricate dynamics of balancing corporate success and employee well-being in a steaming cup of controversy.

Review of Revenue and Operating Profit Trends:

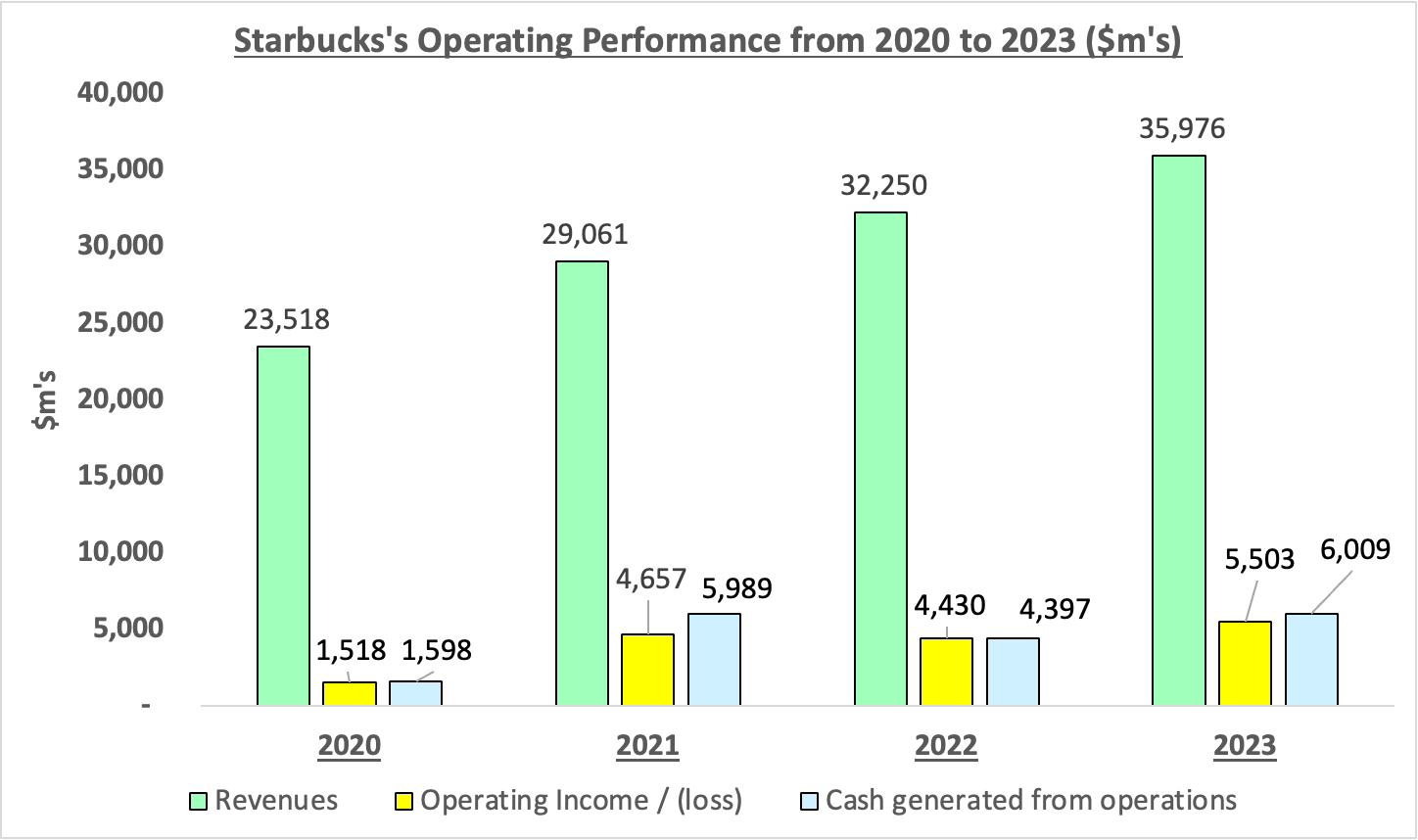

Starbucks has undergone a remarkable financial transformation over the past four years. The revenue and operating profit trends underscore a narrative of robust growth and strategic financial management.

- Stellar Revenue Surge:

From revenues of $23.5 billion in 2020 to a staggering $36 billion in 2023, Starbucks has experienced a meteoric 53% increase in revenue over the four-year period. This exceptional growth speaks to the company's ability to capture and capitalize on the global demand for its premium coffee offerings. The upward trajectory in revenue reflects not only sustained consumer loyalty but also strategic initiatives that have expanded Starbucks' market reach.

- Stratospheric Operating Profit Growth:

The operating profit trajectory is equally impressive, catapulting from $1.5 billion in 2020 to a commanding $5.5 billion in 2023. This represents a remarkable 263% increase over the four financial years. The surge in operating profits underscores Starbucks' adept management of costs, operational efficiency, and value creation.

Review of Starbucks Cash Balance and Cash Flow Trends

Starbucks' financial resilience extends to its cash management, where a strategic balance between inflows and outflows paints a nuanced picture of fiscal prudence.

- Steady Growth in Cash Balance:

Starbucks' cash balance has exhibited a steady upward trajectory, growing from $2.7 billion at the end of 2019 to $3.6 billion in 2023. This growth signals not only a healthy financial position but also the company's ability to generate and retain cash, providing a solid foundation for strategic initiatives and potential market challenges.

- Driving Forces Behind Cash Inflows:

The engine fueling Starbucks' cash reservoir lies in its operating activities. Notably, the years 2021, 2022, and 2023 saw substantial cash generation from operations, amounting to $6 billion, $4.4 billion, and $6 billion, respectively. This robust cash generation underscores the efficiency and profitability of Starbucks' core business operations, highlighting the brand's financial vitality.

- Strategic Cash Outflows and Financing Activities

Key cash outflows are associated with financing activities, totalling $3.7 billion in 2021 and $5.6 billion in 2022. These activities, including stock buybacks and debt repayments.

Starbuck’s Debt Financing

The Accounting Equation is:

- Assets = Liabilities + Equity (i.e., funding & accumulated profits)

Starbuck’s accounting equation is visualised below.

In the intricate realm of accounting, it becomes apparent that despite Starbucks' current profitability and robust financial performance, the company finds itself in a net deficit position. This seemingly paradoxical situation arises from accumulated losses incurred during the early years of the company's journey.

(Note, a net deficit means that Starbuck’s liabilities are greater than its assets).

While Starbucks now stands as a paragon of financial success, the echoes of past challenges linger in the form of historical deficits. These accumulated losses, a remnant of the company's formative years, underscore the resilience and strategic navigation required to transform adversity into enduring profitability.

Breaking Down Starbucks' Financial Leverage: Navigating Gearing Ratio Dynamics

The financial gearing ratio, also known as the debt-to-equity ratio, is a key financial metric that measures the proportion of a company's capital that is financed by debt compared to equity.

A profile of Starbuck’s financial gearing is shown below:

Starbucks' gearing ratio, which stood at 135.4% in 2020, has experienced an increase, reaching 139.7% in 2023. This indicates a higher reliance on debt in comparison to equity in the company's capital structure.

The observed increase in Starbucks' gearing ratio may, in part, be attributed to accumulated losses incurred in the company's earlier years. These historical losses contribute to the denominator (equity) in the gearing ratio calculation, potentially elevating the ratio even when the company is currently profitable.

In essence, while Starbucks' operational performance is robust, the interplay of historical losses and gearing dynamics necessitates a comprehensive understanding of the company's financial landscape.

Key Findings: Financial Triumphs, Challenges, and Implications for Starbucks' Path Ahead

In the context of Starbucks' financial narrative, our exploration has unveiled a contrast of resilience and challenge. The following key findings summarise some of the key findings of Starbucks' financial journey:

Operational Efficiency:

Starbucks stands tall with strong revenue and operating profit performances, culminating in $36 billion in revenues and an impressive $5.5 billion in operating profits during 2023. A noteworthy 15.3% operating profit margin attests to the efficiency and profitability of the company's core operations.

Cash Resilience:

The robust operating cash performance of Starbucks has fortified its financial foundation, resulting in a reported cash balance of $3.6 billion at the close of the 2023 accounting period. This liquidity positions the company well for strategic initiatives and unforeseen challenges.

Gearing Dilemma:

Despite the evident financial prowess, Starbucks grapples with a high gearing ratio, standing at 139.7% in 2023. While historic losses contribute to this metric, the substantial reliance on debt remains a risk factor for the company. The delicate balance between leveraging historical losses and managing current debt underscores the complexities in Starbucks' financial landscape.

The Ongoing Pay Dispute:

Against the backdrop of these financial dynamics, the ongoing pay dispute with employees introduces a poignant layer to the narrative. While Starbucks showcases financial strength on one front, the high gearing ratio and the risks associated with it could potentially impact the resolution of the dispute. The company may face increased scrutiny regarding its financial priorities and the perceived allocation of resources, adding a layer of complexity to the ongoing negotiations.

In conclusion, Starbucks' financial journey is one of triumphs and challenges, with a backdrop of resilience and strategic navigation. The interplay of operational successes, cash resilience, and the looming shadow of high gearing ratio unfolds a narrative that extends beyond numbers.

As the company steams ahead, finding equilibrium between financial strength and the ongoing pay dispute becomes pivotal, shaping the trajectory of Starbucks in the dynamic landscape of corporate responsibility and financial prudence.